Create a new tax

Goal

To create and manage tax rates in the Propeller backoffice for different countries and shops. This ensures the correct VAT or sales tax is applied to purchases, maintaining compliance and accuracy across your commerce platform.

Understanding Tax Configuration

Tax rates in Propeller are configured per shop and country, allowing you to:

- Set different VAT/sales tax rates for various countries

- Manage multiple tax rates within the same country (e.g., high, low and 0 rates)

- Configure tax-free zones for special cases

- Support cross-border commerce with proper tax compliance

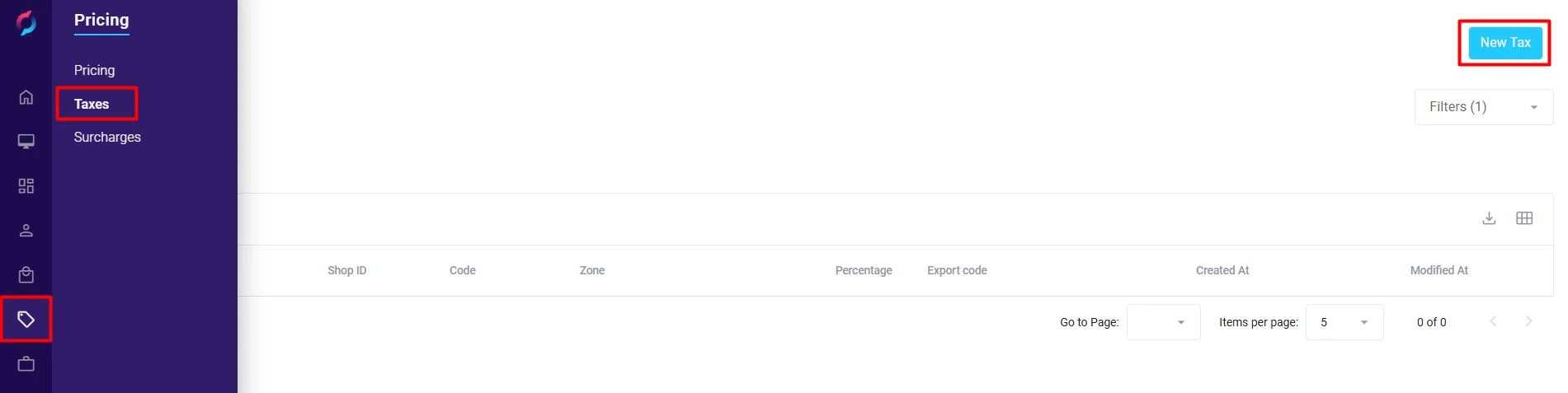

Step 1: Navigate to Taxes

- From the backoffice menu, select Pricing and then Taxes.

- The taxes list displays existing tax rates with:

- Shop assignment

- Code

- Country

- Percentage

- Export code

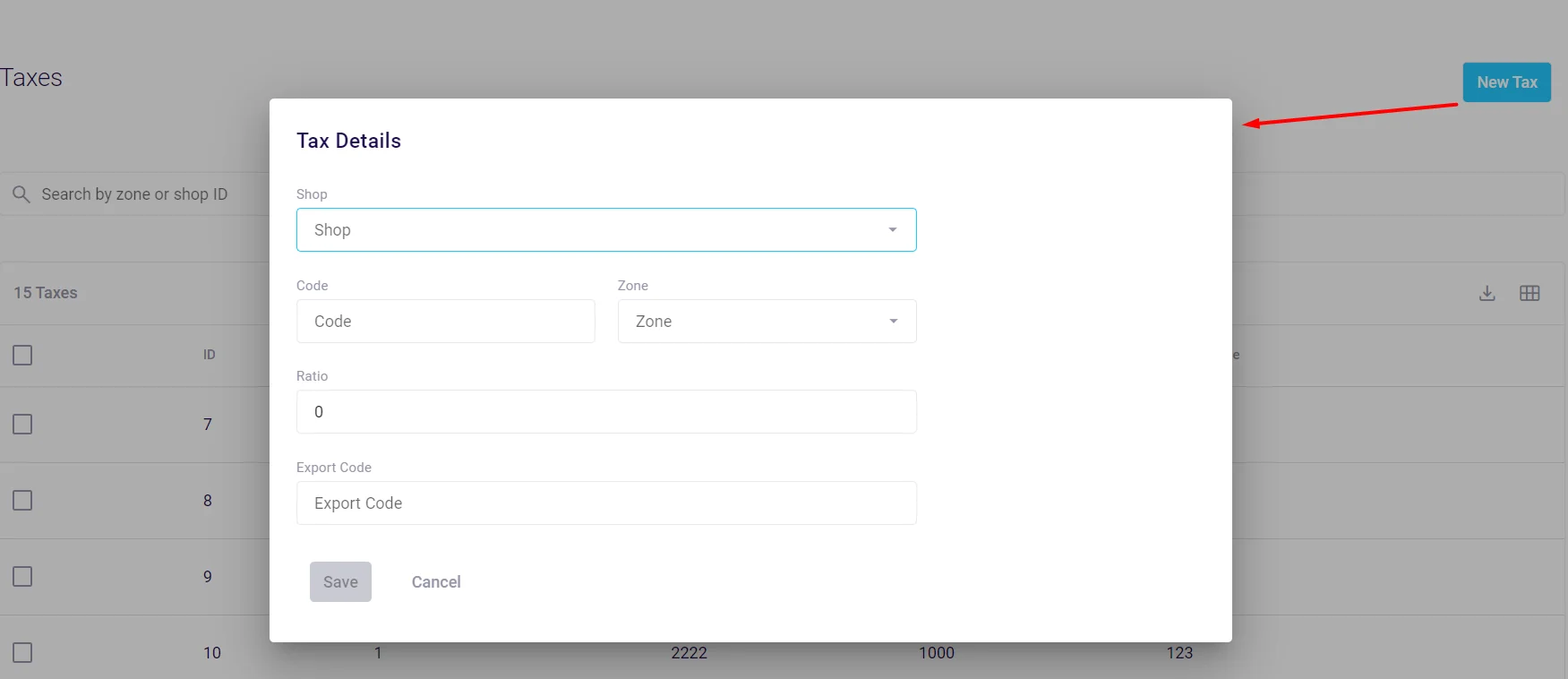

Step 2: Create a New Tax

- Click the New Tax button in the top right corner.

- The New Tax popup window will open.

Step 3: Configure Tax Details

Complete the following fields in the popup:

Required Information

- Shop: Select the shop this tax rate applies to

Tax Identification

- Code: Enter a unique identifier for this tax rate

- Use descriptive codes like "NL_HIGH", "DE_STANDARD", "FR_REDUCED"

- Helps identify tax rates in reports and integrations

- While marked as optional, using codes is recommended

Tax Details

-

Country: Select the country where this tax applies

-

Choose from the dropdown of available countries

-

Leave empty for default/fallback tax rates

-

Percentage: Enter the tax rate as a percentage

-

Examples: 21 for 21% VAT, 19 for 19% sales tax

-

Use decimal values for precise rates (e.g., 7.5)

-

Export Code: Add codes for external systems or reporting

-

Used for integration with accounting systems

-

Examples: "ECV" for European compliance, custom codes for ERP systems

Step 4: Save the Tax

- Review all entered information for accuracy.

- Click Save to create the tax rate.

- The new tax will appear in the taxes list.

- Click Cancel to discard changes.

Common Tax Configurations

Standard EU VAT Rates

- Netherlands: 21% (high), 9% (low)

- Germany: 19% (standard), 7% (reduced)

- Belgium: 21% (standard), 6% (reduced)

- France: 20% (standard), 5.5% (reduced)

Best Practices

- Consistent Naming: Use standardized codes that indicate country and rate type

- Regular Updates: Review tax rates quarterly to ensure compliance with changing regulations

- Complete Configuration: Set up all applicable tax rates before launching

Integration with Orders

Tax rates are automatically applied during checkout based on:

- Customer's delivery address

- Selected shop

- Product tax classifications

EU Intra-Community Supply (ICS)

For EU countries, Propeller supports ICS transactions that allow non-taxable purchases where applicable:

- This is defined on a company delivery address

- Enables 0% VAT for eligible B2B cross-border sales within the EU